Multiple Choice

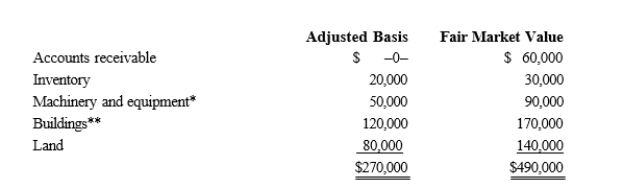

Kristine owns all of the stock of a C corporation which owns the following assets.  * Potential § 1245 recapture of $45,000. ** Straight-line depreciation was used. Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

* Potential § 1245 recapture of $45,000. ** Straight-line depreciation was used. Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Match the following statements.<br>-Net capital loss<br>A)For the

Q38: Match the following statements.<br>-Sale of corporate stock

Q42: Match the following statements.<br>-Sale of corporate stock

Q49: A sole proprietorship files Schedule C of

Q52: For Federal income tax purposes, a business

Q56: Match the following statements.<br>-Technique for minimizing double

Q82: Match the following attributes with the different

Q90: Match the following statements.<br>-Regular tax rate<br>A)For the

Q100: Match each of the following statements with

Q113: Both Malcomb and Sandra shareholders) loan Crow