Essay

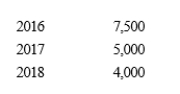

Molly has generated general business credits over the years that have not been utilized.The amounts generated and not utilized equal:

In the current year, 2019, her business generates an additional $15,000 general business credit.In 2019, based on her tax liability before credits, she can utilize a general business credit of up to $20,000.After utilizing the carryforwards and the current year credits, how much of the general business credit generated in 2019 is available for future years?

In the current year, 2019, her business generates an additional $15,000 general business credit.In 2019, based on her tax liability before credits, she can utilize a general business credit of up to $20,000.After utilizing the carryforwards and the current year credits, how much of the general business credit generated in 2019 is available for future years?

a.$0.

b.$1,000.

c.$14,000.

d.$15,000.

Correct Answer:

Verified

c

Total cr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Total cr...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: The AMT adjustment for research and experimental

Q3: In the renovation of its building, Green

Q46: Kerri, who has AGI of $120,000, itemized

Q51: BlueCo incurs $900,000 during the year to

Q53: Because passive losses are not deductible in

Q54: Any unused general business credit must be

Q58: Waltz, Inc., a U.S. taxpayer, pays foreign

Q59: In deciding whether to enact the alternative

Q61: Benita expensed mining exploration and development costs

Q93: Interest income on private activity bonds issued