Multiple Choice

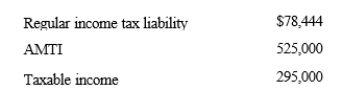

Ashby, who is single and age 30, provides you with the following information from his financial records for 2019.  Calculate his AMT exemption for 2019.

Calculate his AMT exemption for 2019.

A) $0

B) $3,675

C) $68,025

D) $71,700

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: If a taxpayer elects to capitalize and

Q12: Interest on a home equity loan that

Q23: Which of the following statements is correct?<br>A)If

Q24: Cardinal Corporation hires two persons who are

Q41: Cardinal Company incurs $800,000 during the year

Q43: Which of the following statements describing the

Q50: Unused foreign tax credits are carried back

Q52: An employer's tax deduction for wages is

Q79: Business tax credits reduce the AMT and

Q82: Prior to the effect of tax credits,