Multiple Choice

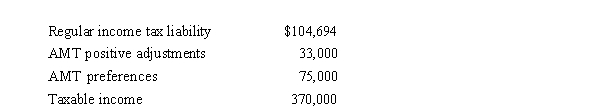

Beulah, who is single and itemizes deductions, provides you with the following information from her financial records for 2019.Compute Beulah's AMTI.

A) $0

B) $368,600

C) $407,700

D) $478,000

E) $490,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: If a taxpayer elects to capitalize and

Q24: Cardinal Corporation hires two persons who are

Q26: After personal property is fully depreciated for

Q32: The purpose of the work opportunity tax

Q41: Cardinal Company incurs $800,000 during the year

Q43: During the year, Green, Inc., incurs the

Q50: Unused foreign tax credits are carried back

Q68: The net capital gain included in an

Q76: In March 2019, Gray Corporation hired two

Q82: Prior to the effect of tax credits,