Multiple Choice

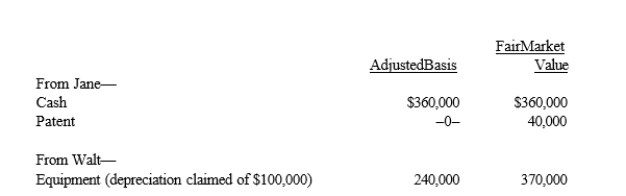

Four individuals form Chickadee Corporation under § 351.Two of these individuals, Jane and Walt, made the following contributions:  Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

A) Jane must recognize income of $40,000; Walt has no income.

B) Neither Jane nor Walt recognize income.

C) Walt must recognize income of $130,000; Jane has no income.

D) Walt must recognize income of $100,000; Jane has no income.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: When Pheasant Corporation was formed under §

Q9: Earl and Mary form Crow Corporation. Earl

Q11: Donald owns a 45% interest in a

Q12: A transferor who receives stock for both

Q13: Canary Corporation, a calendar year C corporation,

Q33: Jane and Walt form Yellow Corporation. Jane

Q39: Eve transfers property (basis of $120,000 and

Q40: When a taxpayer transfers property subject to

Q46: Leah transfers equipment (basis of $400,000 and

Q102: To ease a liquidity problem, all of