Multiple Choice

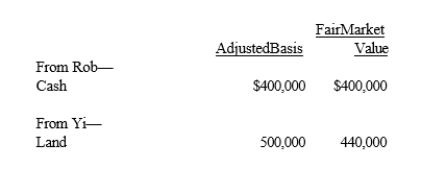

Rob and Yi form Bluebird Corporation with the following investments.  Each receives 50% of Bluebird's stock.In addition, Yi receives cash of $40,000.One result of these transfers is that Yi has a:

Each receives 50% of Bluebird's stock.In addition, Yi receives cash of $40,000.One result of these transfers is that Yi has a:

A) Recognized loss of $60,000.

B) Recognized loss of $20,000.

C) Basis of $460,000 in the Bluebird stock (assuming Bluebird reduces its basis in the land to $440,000) .

D) Basis of $400,000 in the Bluebird stock (assuming Bluebird reduces its basis in the land to $440,000) .

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Hunter and Warren form Tan Corporation. Hunter

Q11: Joe and Kay form Gull Corporation. Joe

Q30: Carl transfers land to Cardinal Corporation for

Q57: Which of the following statements is correct

Q62: A long-term note is treated as "boot."

Q84: Rhonda and Marta form Blue Corporation. Rhonda

Q92: Nancy Smith is the sole shareholder and

Q96: The receipt of nonqualified preferred stock in

Q104: Which of the following statements is incorrect

Q110: Schedule M-2 is used to reconcile unappropriated