Multiple Choice

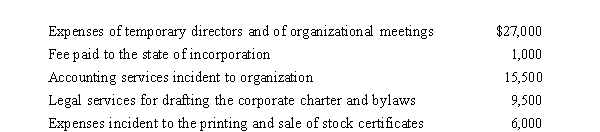

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2019.The following expenses were incurred during the first tax year (April 1 through December 31, 2019) of operations.  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2019?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2019?

A) $0

B) $4,550

C) $5,000

D) $7,400

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Donald owns a 45% interest in a

Q19: Schedule M-1 of Form 1120 is used

Q21: To induce Yellow Corporation to build a

Q23: In determining whether § 357(c) applies, assess

Q26: Schedule M-1 is used to reconcile net

Q33: Jane and Walt form Yellow Corporation. Jane

Q60: When depreciable property is transferred to a

Q65: A taxpayer may never recognize a loss

Q74: In order to retain the services of

Q102: To ease a liquidity problem, all of