Essay

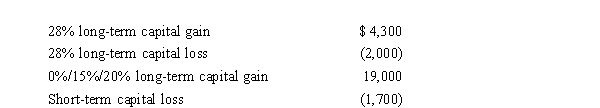

Harold is a head of household, has $27,000 of taxable income in 2019 from noncapital gain or loss sources, and has the following capital gains and losses:  What is Harold's taxable income and the tax on that taxable income (ignore the standard deduction)?

What is Harold's taxable income and the tax on that taxable income (ignore the standard deduction)?

Correct Answer:

Verified

Harold has taxable income of $46,600 and...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Blue Company sold machinery for $45,000 on

Q16: The maximum § 1245 depreciation recapture generally

Q17: Section 1231 lookback losses may convert some

Q34: Since the Code section that defines capital

Q35: A net short-term capital loss first offsets

Q38: Tan, Inc., sold a forklift on April

Q46: Which of the following statements is correct?<br>A)When

Q54: A security that was purchased by an

Q61: For § 1245 recapture to apply, accelerated

Q66: On January 18, 2018, Martha purchased 200