Short Answer

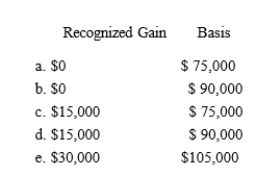

Nat is a salesman for a real estate developer.His employer permits him to purchase a lot for $75,000.The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q20: Wade is a salesman for a real

Q28: A building located in Virginia (used in

Q31: The fair market value of property received

Q34: In computing the amount realized when the

Q51: Bria's office building (basis of $225,000 and

Q63: Reggie owns all the stock of Amethyst,

Q67: If the recognized gain on an involuntary

Q71: Realized losses from the sale or exchange

Q81: Gene purchased for $45,000 an SUV that

Q87: Arthur owns a tract of undeveloped land