Multiple Choice

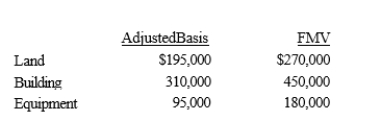

Mona purchased a business from Judah for $1,000,000.Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Capital recoveries include:<br>A)The cost of capital improvements.<br>B)Ordinary

Q4: A realized gain on the sale or

Q25: Milt's building, which houses his retail sporting

Q27: In a deductible casualty or theft, the

Q33: Cole exchanges an asset (adjusted basis of

Q36: If a taxpayer exchanges like-kind property and

Q38: The basis of property acquired in a

Q56: Matt, who is single, sells his principal

Q57: Kelly, who is single, sells her principal

Q60: Dennis, a calendar year taxpayer, owns a