Short Answer

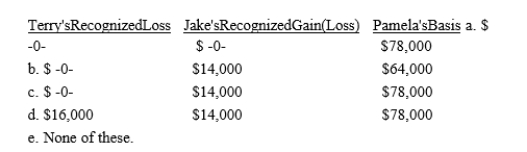

Terry owns Lakeside, Inc.stock (adjusted basis of $80,000), which she sells to her brother, Jake, for $64,000 (its fair market value).Eighteen months later, Jake sells the stock to Pamela, a friend, for $78,000 (its fair market value).What is Terry's recognized loss, Jake's recognized gain or loss, and Pamela's adjusted basis for the stock?

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The amount of the loss basis of

Q14: The taxpayer must elect to have the

Q22: Tobin inherited 100 acres of land on

Q24: Gains and losses on nontaxable exchanges are

Q35: The basis of personal use property converted

Q41: Lynn purchases a house for $52,000.She converts

Q67: Yolanda buys a house in the mountains

Q68: The exchange of unimproved real property located

Q76: If an election to postpone gain under

Q83: Stuart owns land with an adjusted basis