Short Answer

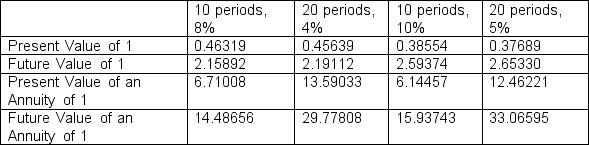

Stevens Company is about to issue $400,000 of 10-year bonds paying an 8% interest rate with interest payable semiannually. The effective interest rate for such securities is 10%. Below are available time value of money factors that Stevens chooses from to calculate compounded interest.

To the closest dollar, how much can Stevens expect to receive for the sale of these bonds?

To the closest dollar, how much can Stevens expect to receive for the sale of these bonds?

a. $350,151

b. $292,637

c. $800,000

d. $1,405,503

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Determine the coupon rate of interest on

Q49: Describe the two cash flows associated with

Q76: On January 1, 2010, Jackson Corporation issued

Q77: On January 1, 2010, Hooper Corporation issued

Q78: McCourt Investment Advisors purchased newly issued bonds

Q79: On September 10, 2009, Humbert Company issued

Q82: Financial instruments that are not listed on

Q84: What is the purpose of interest rate

Q99: A non-interest-bearing obligation<br>A)requires recognition of interest expense

Q106: When the effective interest method is used