Essay

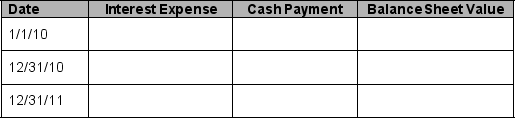

On January 1, 2010, Foster Corporation issued a 2-year, non-interest-bearing, $4,000 note payable. Interest is payable each December 31 during the life of the note. When the note was issued, the market rate of interest was 6%. Complete the following amortization schedule:

Correct Answer:

Verified

$4,000 x ....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: GAAP requires the lessee party to a

Q2: On January 1, 2009, Standard Incorporated is

Q3: On January 1, 2009, Enron Corporation issued

Q4: Capital leases are rental agreements of which<br>A)

Q5: On September 10, 2009, Humbert Company issued

Q8: On January 1, 2009, Mega Company leased

Q9: On January 1, 2009, Parker Company leased

Q63: Bonds payable that are redeemed by the

Q65: On January 1, a 5-year, $4,000 non-interest-bearing

Q121: What are 'off-balance sheet risks'? What disclosures