Essay

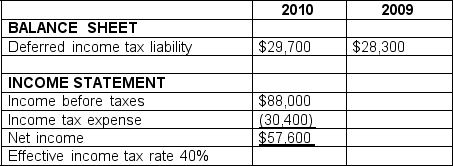

The following information was taken from the annual report of Jones Inc.

Based on this information, what journal entry should Jones make in 2010 to record its income taxes?

Based on this information, what journal entry should Jones make in 2010 to record its income taxes?

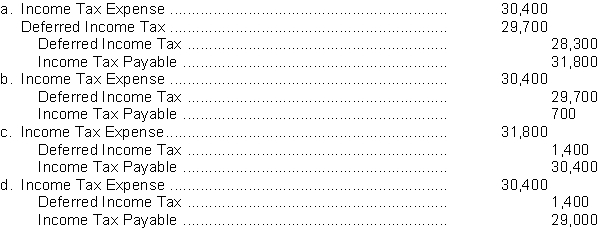

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: Which one of the following events decreases

Q29: Jake Company borrowed $100,000 from Guaranty Trust

Q30: As a security analyst for Market Masters,

Q32: Accruing warranty expense will<br>A)increase the debt/equity ratio.<br>B)increase

Q33: Alpine, Inc. sells baseball tickets for professional

Q35: On December 31, 2009, Barton Incorporated had

Q38: Which one of the following events does

Q39: Contingent liabilities whose ultimate payment is reasonably

Q69: Which one of the following events increases

Q93: The economic essence of one of the