Essay

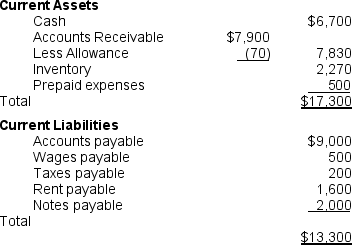

The following information concerning the current assets and current liabilities of

Mason Company at December 31, 2010, is presented below.

Based on this information, what would the quick ratio be if Mason sold all of its inventory for $6,000 cash?

Based on this information, what would the quick ratio be if Mason sold all of its inventory for $6,000 cash?

a. The quick ratio would decrease from 1.09 to 0.19.

b. The quick ratio would decrease from 1.30 to 0.85.

c. The quick ratio would increase from 1.30 to 1.54.

d. The quick ratio would increase from 1.09 to 1.54.

Correct Answer:

Verified

Before: ($6,700 + $7,830)/$13,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: A company has a significant debit or

Q73: The following information is provided for Atlanta,

Q75: On December 31, 2010, Priya Co. has

Q76: The balances of the allowance for doubtful

Q77: How would the quick ratio be affected

Q78: Which of the following would be separately

Q79: The following information was taken from the

Q80: An exchange rate<br>A)is the cash amount received

Q80: Delvin Co. uses the percentage of credit

Q81: The following information is provided for Atlanta