Essay

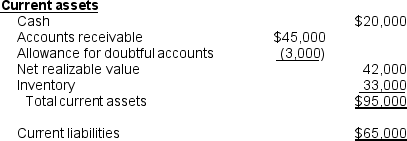

The following is a partial balance sheet for Quenton Company dated December 31, 2010:

During 2010, $4,000 of accounts receivable were written off as uncollectible and bad debts expense recognized on Quenton's 2010 net income statement was $8,000. However, the president of the company believes that $2,500 of these receivables were written off too soon. She believes that there is a good chance that they will be collected next year. There is some historical evidence to back the president's position.

During 2010, $4,000 of accounts receivable were written off as uncollectible and bad debts expense recognized on Quenton's 2010 net income statement was $8,000. However, the president of the company believes that $2,500 of these receivables were written off too soon. She believes that there is a good chance that they will be collected next year. There is some historical evidence to back the president's position.

A partial explanation for her position is that Quenton has a debt covenant requiring it to maintain a current ratio of 1.5. The president believes that by reversing the write-off of $2,500 of accounts receivable, the current assets will be $97,500 and the current ratio will be 1.5. However, the chief financial officer states that a better approach to getting the current ratio to 1.5 is to pay off some accounts payable. If the company paid $5,000 of accounts payable, the current ratio would become the minimum 1.5 required by the debt covenant.

Comment, with numerical illustration, on the president's and chief financial officer's positions.

Correct Answer:

Verified

If the write-off of $2,500 of accounts r...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: At the beginning of 2010, Cyrus Corp.'s

Q10: Hummel Inc. and Nadia Co. have experienced

Q11: On 12/31/09, Phoebe Company's balance sheet revealed

Q11: Which of the following are components of

Q12: The balances of the allowance for doubtful

Q13: The following information concerning the current assets

Q16: Calculate the quick ratio for Pines Company

Q17: On December 11, 2010, Bisbee Co. purchased

Q19: On December 1, 2010, Sedona Trading Co.

Q65: How would the current ratio be affected