Multiple Choice

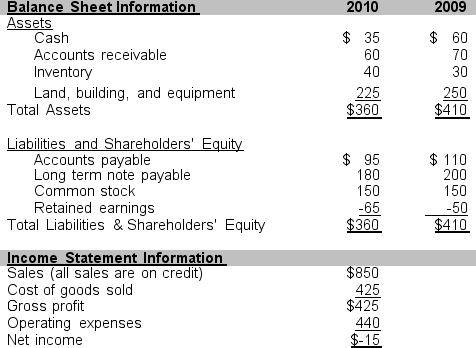

Use the information that follows taken from Campbell Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 45 through 48.

-Calculate Campbell's inventory turnover ratio and accounts receivable turnover ratio for the year ended 2010. Further, assume that in Campbell's industry, the industry average inventory turnover ratio is 12 and the industry average receivables turnover ratio is 14.

A) Campbell's inventory turnover ratio and accounts receivable turnover ratios are better than average for Campbell's industry.

B) Campbell's inventory turnover ratio and accounts receivable turnover ratios are worse than average for Campbell's industry.

C) Campbell's inventory turnover ratio is better but the accounts receivable turnover ratio is worse than average for Campbell's industry.

D) Campbell's inventory turnover ratio is worse and accounts receivable turnover ratio is better than average for Campbell's industry.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: How does operating performance differ from financial

Q14: The current ratio is<br>A)current assets divided by

Q26: Financial flexibility is<br>A)a good indicator of a

Q33: What type of audit report do most

Q54: Assume that the following financial ratios were

Q56: Why are all companies not audited by

Q57: Which one of the following is a

Q58: Using borrowed funds to generate returns for

Q61: Use the information that follows taken from

Q64: An analyst assessed a company and determined