Multiple Choice

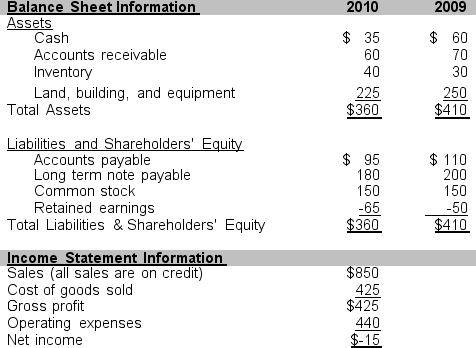

Use the information that follows taken from Campbell Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 45 through 48.

-Calculate Campbell's return on equity and return on assets for the year ended December 31, 2010. Assume that the income tax rate is 30%. Also assume that in Campbell's industry, the industry average return on equity is 19% and the average return on assets is 11%.

A) Campbell's return on equity and return on assets are better than average for Campbell's industry.

B) Campbell's return on equity and return on assets are worse than average for Campbell's industry.

C) Campbell's return on equity is better but return on assets is worse than average for Campbell's industry.

D) Campbell's return on equity is worse but return on assets is better than average for Campbell's industry.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following ratios might a

Q16: Use the information that follows taken from

Q17: Using the two solvency ratios (current and

Q17: How does off-balance-sheet financing make a company

Q18: Use the information that follows taken from

Q22: Use the information that follows taken from

Q23: What must an analyst learn first prior

Q35: Which of the following ratios would be

Q60: A company that reports high levels of

Q87: The primary measure of the overall success