Essay

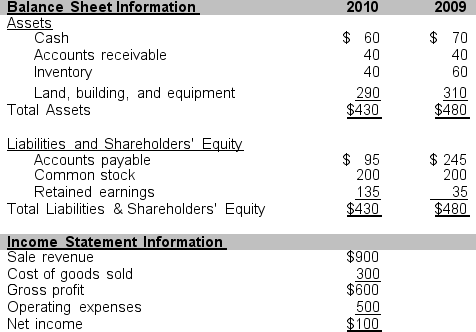

Use the information that follows taken from Carter Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 3 through 9.

-The industry in which Carter is a member has an average return on assets of 18%. Carter reported no interest expense during 2010. Determine if Carter is more or less profitable in 2010 than the average firm in its industry.

Correct Answer:

Verified

Carter's return on assets is ...

Carter's return on assets is ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Financial statements help present and potential investors,

Q23: Book value fails to reflect true value

Q27: Operating performance is a company's ability to<br>A)control

Q45: The quick ratio helps assess a company's<br>A)annual

Q53: Investors who use accounting information to guide

Q55: Which of the following ratios would be

Q63: Return on equity helps assess a company's<br>A)marketability.<br>B)solvency.<br>C)profitability.<br>D)leverage.

Q87: Walker Company has the following assets on

Q88: Buffalo Company has current assets, current liabilities,

Q93: Match the correct ratio name from the