Essay

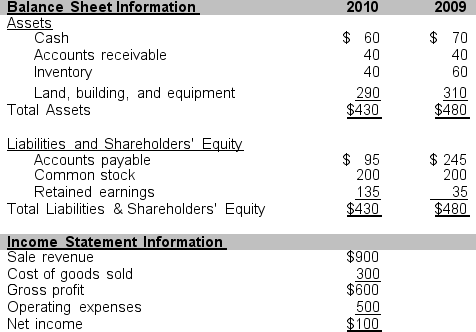

Use the information that follows taken from Carter Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 3 through 9.

-The industry in which Carter is a member has an average debt/equity ratio of 0.83. Determine if, as measured by the debt/equity ratio on December 31, 2010, Carter is taking full advantage of investing borrowed capital in its operations relative to that of the average firm in its industry. Explain.

Correct Answer:

Verified

Debt/equity ratio = Average total liabil...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Identify two forms of analyzing financial statements

Q74: Sheena Company has current assets, current liabilities,

Q75: For each characteristic which appears numbered from

Q76: The following ratios were computed from the

Q78: Common-size financial statements are expressed as<br>A) percentages

Q80: The current ratio<br>A) provides users with an

Q81: Use the information that follows taken from

Q82: A standard audit report states that the

Q84: Norton Company has the following assets on

Q92: The dividend yield ratio helps assess the<br>A)profitability