Essay

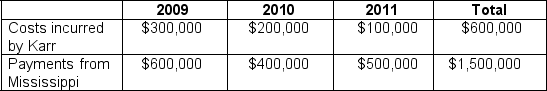

Karr Construction built a levee for the state of Mississippi over a three-year period. The contracted price for the levee was $1,200,000. The costs incurred by Karr and the payments from the state over the three year period are as follows:

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2011?

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2011?

a. $600,000

b. $400,000

c. $300,000

d. $150,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which one of the following is violated

Q6: Name the four basic assumptions of financial

Q30: The most common point of revenue recognition

Q39: The stable dollar assumption assumes that:<br>A)the monetary

Q68: Which one of the following is violated

Q81: Explain the concept of face value.<br>

Q83: Seinfeld Company has land with an original

Q87: During 2010, Hamot Company sold $30,000 of

Q88: The valuation basis used to measure accounts

Q90: Three years ago, Astro Masters, Inc. purchased