Multiple Choice

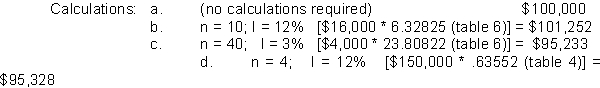

-Everett Corporation issues a 8%, 9-year mortgage note on January 1, 2009, to obtain financing for new equipment. Land is used as collateral for the note. The terms provide for semiannual installment payments of $131,600. The following values related to the time value of money were available to Everett to help them with their planning process and compounded interest decisions.  To the closest dollar, what were the cash proceeds received from the issuance of the note?

To the closest dollar, what were the cash proceeds received from the issuance of the note?

A) $822,091

B) $947,520

C) $1,665,964

D) $1,643,363

Correct Answer:

Verified

Correct Answer:

Verified

Q25: How does an annuity due differ from

Q26: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -Karla Simpson invested

Q27: The following computation took place: $20,000 divided

Q28: Carter Holding Co. intends to purchase a

Q29: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -For each of

Q31: Interest is compounded annually. What is the

Q32: Interest is compounded quarterly on a $10,000

Q33: Malcom Corp. will deposit $10,000 annually at

Q34: You need to calculate the present value

Q35: Flores Company borrowed $10,000 at 10% interest