Multiple Choice

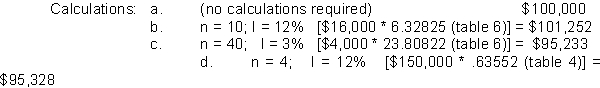

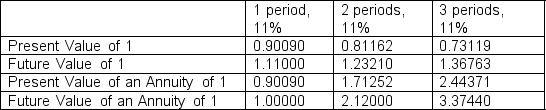

-Gaynor Company is considering purchasing equipment. The equipment will produce the following cash flows: Year 1, $25,000; Year 2, $45,000; Year 3, $60,000. Below is some of the time value of money information that Gaynor has compiled that might help them in their planning and compounded interest decisions.  Gaynor requires a minimum rate of return of 11%. To the closest dollar, what is the maximum price Gaynor should pay for the equipment?

Gaynor requires a minimum rate of return of 11%. To the closest dollar, what is the maximum price Gaynor should pay for the equipment?

A) $117,117

B) $102,917

C) $165,253

D) $246,209

Correct Answer:

Verified

Correct Answer:

Verified

Q11: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -Turner Company is

Q12: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -Mitch has been

Q13: How much would you deposit today in

Q14: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -Mitch has been

Q15: Calculate the future value of equal semiannual

Q17: To determine how much must be deposited

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -How much must

Q19: Sierra Capital wants to accumulate $100,000 at

Q20: Critical Thinking AICPA FN: Measurement <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg"

Q21: Present value is<br>A) how much today's money