Multiple Choice

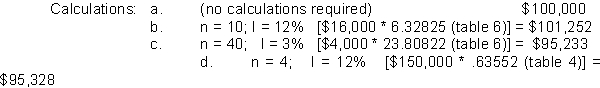

-Mitch has been offered three different contracts for a service he provides. Contract 1: $9,000 received at the beginning of each year for ten years, compounded at a 6 percent annual rate.

Contract 2: $9,000 received today and $20,000 received ten years from today. The relevant interest rate is 12 percent.

Contract 3: $9,000 received at the end of Years 4, 5, and 6. The relevant annual interest rate is 10 percent.

What is the present value of Contract 2?

A) $9,337.13

B) $71,117.00

C) $29,000.00

D) $15,439.40

Correct Answer:

Verified

Correct Answer:

Verified

Q1: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -Kaitlin is contemplating

Q2: Which timing of payments is true for

Q3: An annuity due and an ordinary annuity

Q5: Critical Thinking AICPA FN: Measurement <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg"

Q6: Explain the concept of the "time value

Q7: How does inflation affect the value of

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -Thomas Young invested

Q9: Critical Thinking AICPA FN: Measurement <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg"

Q10: The phone rings. You answer, "Hello." Is

Q11: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -Turner Company is