Multiple Choice

-Morgan is considering entering into a contract to sell a building on January 1 in exchange for a note. The note pays a lump sum payment of $300,000 in ten years and ten annual payments of $2,500 beginning on the date of sale (January 1) . If the annual interest rate is 10 percent, what is the total present value of the contract?

A) $159,489.92

B) $132,559.55

C) $131,023.42

D) $155,505.55

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Flores Company borrowed $10,000 at 10% interest

Q36: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -Harrison Marshall borrowed

Q37: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -Stranton Company is

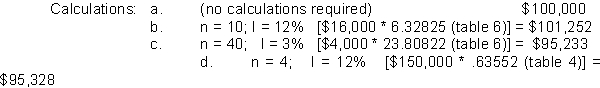

Q38: Calculate the contract price of equipment that

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -Rowan and Lisa

Q40: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -Jim Hall invested

Q41: On July 1, 2009, Roseland Inc. purchased

Q42: Miracle Corporation wants to withdraw $60,000 from

Q44: How much is interest revenue for 90

Q45: Why is present value not used more