Multiple Choice

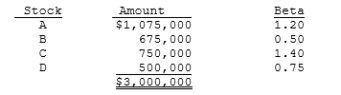

Assume that you are the portfolio manager of the SF Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 11.00% and the risk-free rate is 5.00%. What rate of return should investors expect (and require) on this fund?

A) 10.56%

B) 10.83%

C) 11.11%

D) 11.38%

E) 11.67%

Correct Answer:

Verified

Correct Answer:

Verified

Q71: Which of the following is <u>NOT</u> a

Q72: Assume that your uncle holds just one

Q74: Assume that to cool off the economy

Q75: The risk-free rate is 6%; Stock A

Q78: Jim Angel holds a $200,000 portfolio consisting

Q79: Which of the following is most likely

Q80: An individual stock's diversifiable risk, which is

Q92: A firm can change its beta through

Q119: If the price of money (e.g., interest

Q125: The SML relates required returns to firms'