Multiple Choice

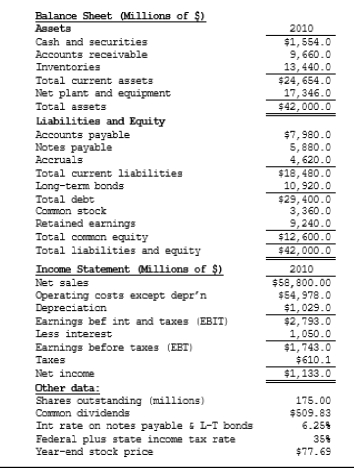

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-What is the firm's dividends per share?

A) $2.62

B) $2.91

C) $3.20

D) $3.53

E) $3.88

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A decline in a firm's inventory turnover

Q22: Significant variations in accounting methods among firms

Q24: Safeco's current assets total to $20 million

Q26: The basic earning power ratio (BEP) reflects

Q29: Which of the following would indicate an

Q34: Orono Corp.'s sales last year were $435,000,

Q35: Last year Urbana Corp.had $197,500 of assets,

Q45: Rappaport Corp.'s sales last year were $320,000,

Q57: Walter Industries' current ratio is 0.5.Considered alone,which

Q93: Suppose Firms A and B have the