Multiple Choice

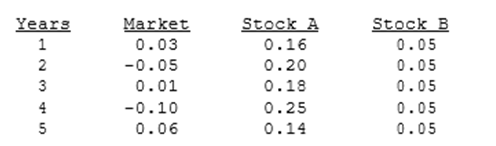

You have the following data on (1) the average annual returns of the market for the past 5 years and (2) similar information on Stocks A and B. Which of the possible answers best describes the historical betas for A and B?

A) .

B) .

C) .

D) .

E) .

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: We will almost always find that the

Q2: Which of the following is <u><b>NOT</b></u> a

Q3: Stock A's beta is 1.5 and Stock

Q4: You are given the following returns

Q4: Arbitrage pricing theory is based on the

Q9: Which of the following statements is CORRECT?<br>A)

Q10: The Y-axis intercept of the SML indicates

Q20: If you plotted the returns of Selleck

Q29: If the returns of two firms are

Q31: In portfolio analysis, we often use ex