Multiple Choice

Volunteer Fabricators, Inc. (VF) currently has zero debt. It is a zero growth company, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

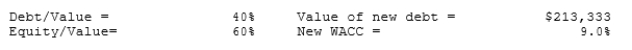

-Now assume that VF is considering changing from its original zero debt capital structure to a new capital structure with even more debt. This results in changes in the cost of debt and equity, and thus to a new WACC and a new value of operations. Assume VF raises the amount of new debt indicated below and uses the funds to purchase and hold T-bills until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

A) $50.67

B) $53.33

C) $56.00

D) $58.80

E) $61.74

Correct Answer:

Verified

Correct Answer:

Verified

Q16: The trade-off theory states that the capital

Q20: Companies HD and LD have identical tax

Q21: The Congress Company has identified two methods

Q22: Which of the following statements is CORRECT?<br>A)

Q24: If debt financing is used, which of

Q28: Which of the following statements is CORRECT?<br>A)

Q30: Companies HD and LD have the same

Q36: The graphical probability distribution of ROE for

Q51: A firm's business risk is largely determined

Q89: Financial risk refers to the extra risk