Multiple Choice

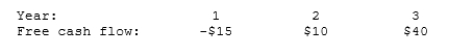

A company forecasts the free cash flows (in millions) shown below. The weighted average cost of capital is 13%, and the FCFs are expected to continue growing at a 5% rate after Year 3. Assuming that the ROIC is expected to remain constant in Year 3 and beyond, what is the Year 0 value of operations, in millions?

A) $315

B) $331

C) $348

D) $367

E) $386

Correct Answer:

Verified

Correct Answer:

Verified

Q14: If a company's expected return on invested

Q15: Which of the following does <u><b>NOT</b></u> always

Q16: Leak Inc. forecasts the free cash flows

Q18: Suppose Yon Sun Corporation's free cash flow

Q20: Which of the following is <u><b>NOT</b></u> normally

Q22: Two important issues in corporate governance are

Q22: Value-based management focuses on sales growth, profitability,

Q23: Based on the corporate valuation model, the

Q24: Suppose Leonard, Nixon, & Shull Corporation's projected

Q71: Free cash flows should be discounted at