Multiple Choice

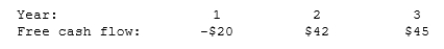

Vasudevan Inc. forecasts the free cash flows (in millions) shown below. If the weighted average cost of capital is 13% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the Year 0 value of operations, in millions?

A) $586

B) $617

C) $648

D) $680

E) $714

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The CEO of D'Amico Motors has been

Q1: Based on the corporate valuation model, the

Q2: Based on the corporate valuation model, Hunsader's

Q5: Which of the following is <u><b>NOT</b></u> normally

Q6: Based on the corporate valuation model, Bernile

Q7: Simonyan Inc. forecasts a free cash flow

Q8: Zhdanov Inc. forecasts that its free cash

Q10: Which of the following statements is <u><b>NOT</b></u>

Q49: A poison pill is also known as

Q78: The corporate valuation model cannot be used