Multiple Choice

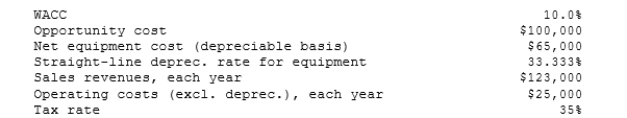

TexMex Food Company is considering a new salsa whose data are shown below. The equipment to be used would be depreciated by the straight- line method over its 3-year life and would have a zero salvage value, and no new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. However, this project would compete with other TexMex products and would reduce their pre-tax annual cash flows. What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.)

A) $3,636

B) $3,828

C) $4,019

D) $4,220

E) $4,431

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Because of improvements in forecasting techniques, estimating

Q36: Your company, RMU Inc., is considering a

Q41: Suppose a firm's CFO thinks that an

Q42: Dalrymple Inc. is considering production of a

Q44: Clemson Software is considering a new project

Q57: Which of the following statements is CORRECT?<br>A)

Q62: Accelerated depreciation has an advantage for profitable

Q63: If debt is to be used to

Q70: The primary advantage to using accelerated rather

Q72: Currently,Powell Products has a beta of 1.0,and