Multiple Choice

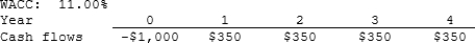

Tuttle Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

A) $77.49

B) $81.56

C) $85.86

D) $90.15

E) $94.66

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: The internal rate of return is that

Q23: Projects S and L both have an

Q47: The IRR of normal Project X is

Q59: Project S has a pattern of high

Q68: Maxwell Feed & Seed is considering a

Q69: Taggart Inc. is considering a project that

Q71: Assume that the economy is in a

Q73: Warnock Inc. is considering a project that

Q74: Lasik Vision Inc. recently analyzed the project

Q77: You are on the staff of Camden