Multiple Choice

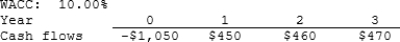

Cornell Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected.

A) $ 92.37

B) $ 96.99

C) $101.84

D) $106.93

E) $112.28

Correct Answer:

Verified

Correct Answer:

Verified

Q10: When evaluating mutually exclusive projects, the modified

Q30: McCall Manufacturing has a WACC of 10%.

Q32: Warr Company is considering a project that

Q33: Which of the following statements is CORRECT?<br>A)

Q33: Which of the following statements is CORRECT?<br>A)

Q35: The phenomenon called "multiple internal rates of

Q67: Which of the following statements is CORRECT?<br>A) A

Q77: The NPV method is based on the

Q78: If the IRR of normal Project X

Q83: Which of the following statements is CORRECT?