Multiple Choice

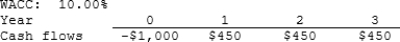

Ehrmann Data Systems is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Note that a project's MIRR can be less than the WACC (and even negative) , in which case it will be rejected.

A) 9.32%

B) 10.35%

C) 11.50%

D) 12.78%

E) 14.20%

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Westchester Corp.is considering two equally risky,mutually exclusive

Q34: The NPV and IRR methods, when used

Q39: Projects S and L are equally risky,mutually

Q40: Which of the following statements is CORRECT?<br>A)

Q62: Conflicts between two mutually exclusive projects occasionally

Q77: You are on the staff of Camden

Q81: Which of the following statements is CORRECT?<br><br>A) Trade

Q83: Projects A and B have identical expected

Q84: You are considering two mutually exclusive, equally

Q101: The NPV method's assumption that cash inflows