True/False

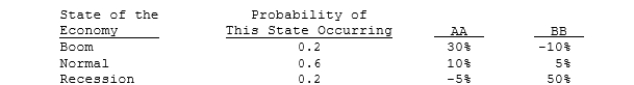

The distributions of rates of return for Companies AA and BB are given below:  We can conclude from the above information that any rational, risk- averse investor would be better off adding Security AA to a well- diversified portfolio over Security BB.

We can conclude from the above information that any rational, risk- averse investor would be better off adding Security AA to a well- diversified portfolio over Security BB.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Scheuer Enterprises has a beta of 1.10,

Q28: You observe the following information regarding

Q29: Bob has a $50,000 stock portfolio with

Q31: Jane has a portfolio of 20 average

Q61: During the coming year, the market risk

Q78: Assume that investors have recently become more

Q98: Stocks A,B,and C all have an expected

Q104: We would generally find that the beta

Q116: Risk-averse investors require higher rates of return

Q120: Bill Dukes has $100,000 invested in a