Multiple Choice

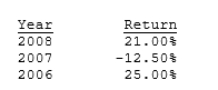

Returns for the Dayton Company over the last 3 years are shown below. What's the standard deviation of the firm's returns? (Hint: This is a sample, not a complete population, so the sample standard deviation formula should be used.)

A) 20.08%

B) 20.59%

C) 21.11%

D) 21.64%

E) 22.18%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: Stock A has an expected return of

Q17: Any change in its beta is likely

Q81: The tighter the probability distribution of its

Q87: Stock A has an expected return of

Q115: According to the Capital Asset Pricing Model,

Q121: Stock X has a beta of 0.5

Q124: The risk-free rate is 6%; Stock A

Q126: Stock HB has a beta of 1.5

Q129: Stock A has a beta of 0.8

Q131: Levine Inc. is considering an investment that