Multiple Choice

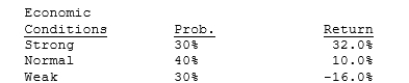

Magee Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns? (Hint: Use the formula for the standard deviation of a population, not a sample.)

A) 17.69%

B) 18.62%

C) 19.55%

D) 20.52%

E) 21.55%

Correct Answer:

Verified

Correct Answer:

Verified

Q2: For markets to be in equilibrium, that

Q6: You have the following data on

Q7: A stock with a beta equal to

Q8: Bruce Niendorf holds the following portfolio: <img

Q32: Bad managerial judgments or unforeseen negative events

Q34: Even if the correlation between the returns

Q74: Assume that two investors each hold a

Q81: Preston Inc.'s stock has a 25% chance

Q126: Stock A has a beta of 0.8,Stock

Q143: Company A has a beta of 0.70,