Multiple Choice

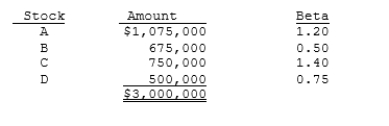

Assume that you are the portfolio manager of the SF Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 11.00% and the risk-free rate is 5.00%. What rate of return should investors expect (and require) on this fund?

A) 10.56%

B) 10.83%

C) 11.11%

D) 11.38%

E) 11.67%

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which of the following statements is CORRECT?<br>A)

Q7: Over the past 75 years, we have

Q43: A mutual fund manager has a $40

Q65: Stock X has a beta of 0.6,

Q67: Stocks A and B each have an

Q73: Data for Dana Industries is shown

Q80: Stock A's beta is 1.5 and Stock

Q120: Which of the following statements is CORRECT?<br>A)

Q122: Stock A has a beta of 0.7,whereas

Q123: Under the CAPM, the required rate of