Short Answer

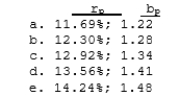

Assume that you hold a well-diversified portfolio that has an expected return of 12.0% and a beta of 1.20. You are in the process of buying 100 shares of Alpha Corp at $10 a share and adding it to your portfolio. Alpha has an expected return of 15.0% and a beta of 2.00. The total value of your current portfolio is $9,000. What will the expected return and beta on the portfolio be after the purchase of the Alpha stock?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Arbitrage pricing theory is based on the

Q7: A stock with a beta equal to

Q8: Data for Oakdale Furniture, Inc. is shown

Q9: Which of the following statements is CORRECT?<br>A)

Q10: The returng on the market, the

Q12: If investors are risk averse and hold

Q15: You hold a diversified portfolio consisting of

Q20: If you plotted the returns of Selleck

Q25: Which of the following statements is CORRECT?<br>A)

Q29: If the returns of two firms are