Multiple Choice

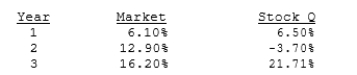

You are given the following returns on "the market" and Stock Q during the last three years. We could calculate beta using data for Years 1 and 2 and then, after Year 3, calculate a new beta for Years 2 and 3. How different are those two betas, i.e., what's the value of beta 2 - beta 1? (Hint: You can find betas using the Rise-Over-Run method, or using your calculator's regression function.)

A) 7.89

B) 8.30

C) 8.74

D) 9.20

E) 9.66

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Stock A's beta is 1.5 and Stock

Q13: Consider the following information and then calculate

Q14: You have the following data on three

Q19: Which of the following are the factors

Q20: You are holding a stock with a

Q21: Which is the best measure of risk

Q22: We will almost always find that the

Q22: You have the following data on

Q24: The slope of the SML is determined

Q31: In portfolio analysis, we often use ex