Short Answer

(The following data apply to Problems 63, 64, and 65. The problems MUST be kept together.)

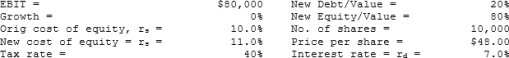

Volunteer Fabricators, Inc. (VF) currently has zero debt. It is a zero growth company, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

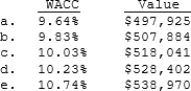

-If this plan were carried out, what would be VF's new WACC and its new value of operations?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Simon Software Co. is trying to estimate

Q15: Which of the following events is likely

Q19: Which of the following statements is CORRECT?<br>A)

Q21: The Congress Company has identified two methods

Q30: Companies HD and LD have the same

Q31: Volga Publishing is considering a proposed increase

Q32: Based on the information below, what is

Q50: If a firm utilizes debt financing, an

Q51: A firm's business risk is largely determined

Q56: Assume that PP is considering changing from