Multiple Choice

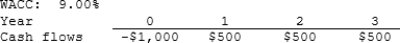

Anderson Systems is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

A) $265.65

B) $278.93

C) $292.88

D) $307.52

E) $322.90

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Assume that the economy is enjoying a

Q26: Which of the following statements is CORRECT?<br>A)

Q27: When considering two mutually exclusive projects, the

Q30: McCall Manufacturing has a WACC of 10%.

Q37: The NPV and IRR methods, when used

Q47: The IRR of normal Project X is

Q82: Which of the following statements is CORRECT?<br>A)

Q83: The primary reason that the NPV method

Q89: Resnick Inc. is considering a project that

Q92: Yonan Inc. is considering Projects S and