Multiple Choice

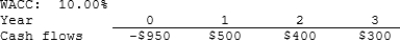

Warnock Inc. is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected.

A) $54.62

B) $57.49

C) $60.52

D) $63.54

E) $66.72

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: When evaluating mutually exclusive projects, the modified

Q24: Normal Projects S and L have the

Q29: Which of the following statements is CORRECT?<br>A)

Q32: Jazz World Inc. is considering a project

Q34: Hindelang Inc. is considering a project that

Q66: One advantage of the payback method for

Q77: The NPV method is based on the

Q79: Project X's IRR is 19% and Project

Q84: Which of the following statements is CORRECT?<br>A)

Q104: Assume a project has normal cash flows.All