Multiple Choice

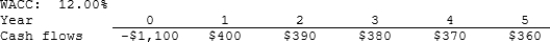

Barry Company is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected.

A) $250.15

B) $277.94

C) $305.73

D) $336.31

E) $369.94

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Ehrmann Data Systems is considering a project

Q13: Four of the following statements are truly

Q18: Simkins Renovations Inc. is considering a project

Q31: Westchester Corp.is considering two equally risky,mutually exclusive

Q83: Which of the following statements is CORRECT?

Q87: No conflict will exist between the NPV

Q94: Which of the following statements is CORRECT?

Q99: Which of the following statements is CORRECT?<br>A)

Q101: The NPV method's assumption that cash inflows

Q107: A firm should never accept a project