Multiple Choice

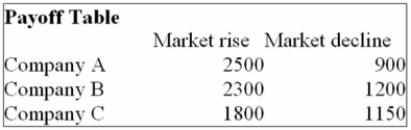

You are trying to decide in which of the three companies you should invest. Refer to the following

Payoff Table.

If the probability of the Market rising in the next year is 0.50, which of the following statements are

Correct?

i. The Expected Monetary Value for Company A is $1,450.

ii. The Expected Monetary Value for Company B is $1,600.

iii. The Expected Monetary Value for Company C is $1,475.

A) (i) , (ii) , and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii) .

C) (i) and (iii) are correct statements but not (ii) .

D) (i) and (ii) are correct statements but not (iii) .

E) (i) , (ii) , and (iii) are all false statements.

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Listed below is the net sales in

Q60: You are trying to decide in which

Q61: The events on Sept 11, 2001 exerted

Q63: What is the forecast for year 9?

Q65: i. A typical monthly seasonal index of

Q68: What is Log10 of the forecast for

Q69: A decision tree:<br>A) uses a box to

Q71: What is the correct order of events

Q78: A time series is a collection of

Q79: What is the long-term behavior of a