Multiple Choice

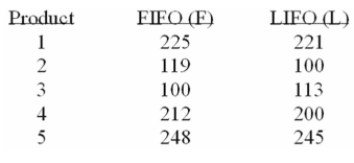

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or

FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five

Products both ways. Based on the following results, is LIFO more effective in keeping the value of

His inventory lower?

What is the null hypothesis?

A) µF = µL, or µd = 0

B) µF ≠ µL, or µd ≠ 0

C) µF ≤ µL

D) µF > µL

Correct Answer:

Verified

Correct Answer:

Verified

Q33: To compare the effect of weather on

Q34: If the null hypothesis that two means

Q35: Accounting procedures allow a business to evaluate

Q36: A local retail business wishes to determine

Q37: The results of a mathematics placement exam

Q39: A national manufacturer of ball bearings is

Q40: A national manufacturer of ball bearings is

Q41: To compare the effect of weather on

Q42: A local retail business wishes to determine

Q43: To compare the effect of weather on