Multiple Choice

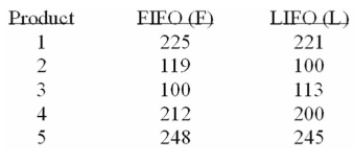

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or

FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five

Products both ways. Based on the following results, is LIFO more effective in keeping the value of

His inventory lower?

What is the degree of freedom?

A) 4

B) 5

C) 15

D) 10

E) 9

Correct Answer:

Verified

Correct Answer:

Verified

Q72: The employees at the East Vancouver office

Q73: The results of a mathematics placement exam

Q74: i. If we are testing for the

Q75: The employees at the East Vancouver office

Q76: Accounting procedures allow a business to evaluate

Q78: An investigation of the effectiveness of a

Q79: A national manufacturer of ball bearings is

Q80: Using two independent samples, two population means

Q81: To compare the effect of weather on

Q82: The employees at the East Vancouver office