Multiple Choice

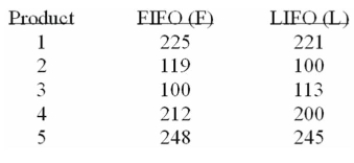

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or

FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five

Products both ways. Based on the following results, is LIFO more effective in keeping the value of

His inventory lower?

What is the value of calculated t?

A) +0.93

B) ±2.776

C) +0.0.47

D) -2.028

Correct Answer:

Verified

Correct Answer:

Verified

Q39: A national manufacturer of ball bearings is

Q40: A national manufacturer of ball bearings is

Q41: To compare the effect of weather on

Q42: A local retail business wishes to determine

Q43: To compare the effect of weather on

Q45: Of 250 adults who tried a new

Q46: Married women are more often than not

Q47: i. If the null hypothesis states that

Q48: For a hypothesis comparing two population means,

Q49: Married women are more often than not