Essay

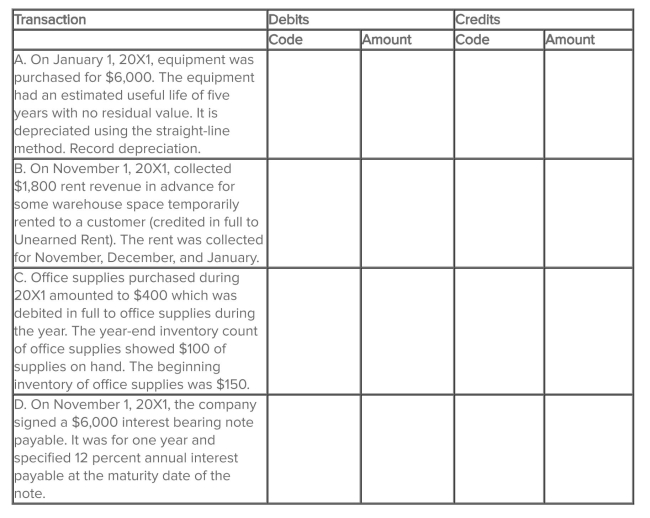

Atlantic Company is completing the information processing cycle at the end of the annual accounting period, December 31, 20X1. Four adjusting entries must be made at this date to update the accounts. The following accounts, selected from Atlantic's chart of accounts, are to be used for this purpose. They are coded to the left for easy reference. You are to indicate the appropriate account code and amount for each required adjusting entry at December 31, 20X1

Correct Answer:

Verified

A. [($6,000 - 0) ÷ 5] = $1,200...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: The earnings statement of Waylon Taylor

Q81: Service revenue earned but not yet collected

Q82: Manitoba Metals Ltd lent $100,000 to Coltraine

Q83: <span class="ql-formula" data-value="\begin{array}{l}\text { Time Corporation reported

Q84: Rent of $150 collected in advance was

Q86: Which one of the following accounts would

Q87: The bank statements of Waylon Taylor

Q88: On December 1, 20X1, Pest Company collected

Q89: <span class="ql-formula" data-value="\begin{array}{l}\text { At the end

Q90: The primary difference between prepaid and accrued